Credit and customer risk

Proactively manage your customers’ financial risk

Access all the information you need to make informed credit decisions, reduce losses and improve cash flow.

Anticipate and fully control customer risk

Get a global view

Adapt your collection strategies

Improve negotiations

Optimize your cash flow

Opt for a comprehensive solution to assess all financial risks

Choose a solution that enables you to assess all potential financial risks, such as insolvency and non-payment, so you can take proactive measures to minimize their impact.

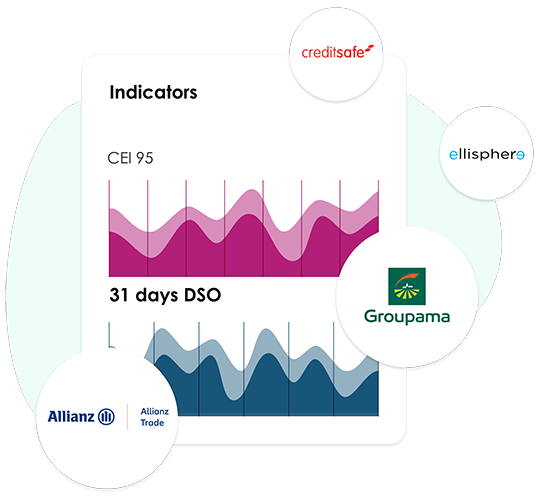

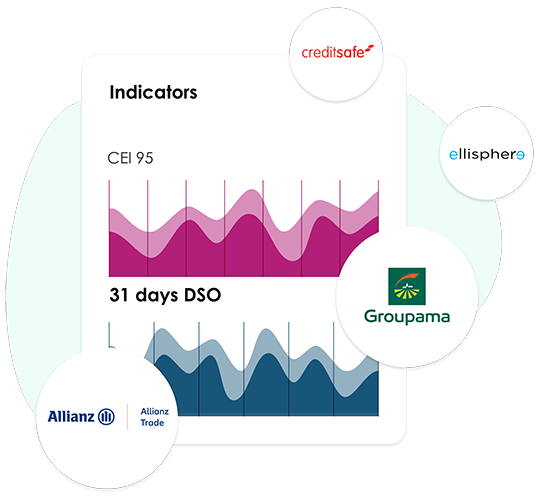

With CashOnTime, you get a 360° view of your customers’ financial information in real time, giving you crucial data for more effective management:

- Real-time calculation of performance indicators (DSO, CEI) and payment behavior indicators (DBT) to assess your customers’ reliability.

- Risk exposure measurement to monitor overruns on high-risk customers.

- Calculation of customer scoring for an accurate assessment of their creditworthiness.

- Determination of internal credit limits to improve commercial negotiations.

- Access to external credit indicators through connectivity with financial information providers and credit insurers.

- Calculation of customer provisions to anticipate and manage potential bad debts.

Stay informed in real time and react efficiently

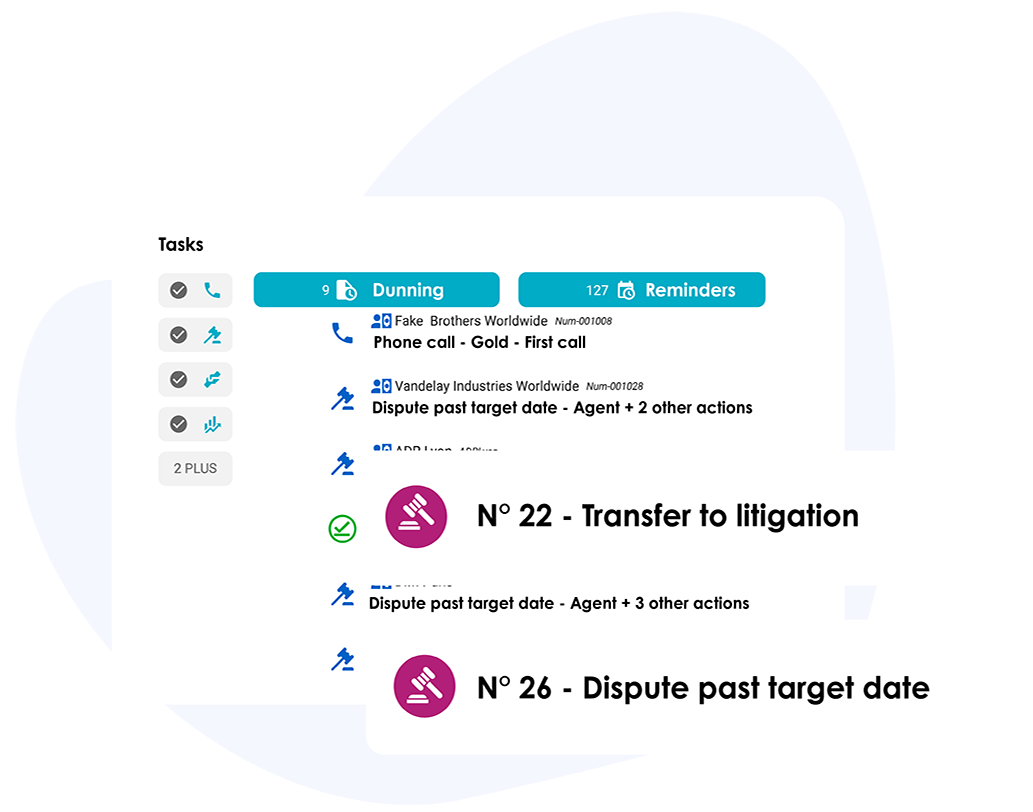

Adapt your collection strategies dynamically thanks to a personalized assessment of each customer’s financial risk.

This targeted approach enables you to adjust payment terms in real time, draw up customized repayment plans and deploy specific collection actions for high-risk customers.

Set up an alert policy to be instantly informed of critical situations:

- Non-compliance with a promise to pay.

- Delay in processing disputes not respected.

- Change of customer risk class.

- Customized credit limit threshold reached.

- Significant variations in payment habits.

- Failure of an affiliated company affecting the customer’s solvency.

Manage your credit insurance

Simplify your customer warranty management with CashOnTime connectors.

Save precious time by avoiding errors and tedious data entry, thanks to automatic, reliable updating.

- Centralize all necessary information in one place, simplifying access to customer data (named and unnamed), permanent and temporary credit application tracking, utilization and application history.

- Manage your internal credit limits or directional credits, by defining your own credit approval thresholds, based on collateral obtained, giving you total control over the volume of business with your customers.

- Be alerted in real time thanks to configurable alerts, enabling you to react quickly to important changes such as changes in guarantees or credit limit overruns.

- Automatic, detailed history of past operations, facilitating full traceability of transactions and simplifying any audits that may be required.

Our customers' testimonials

We use the Risk Connector, which tells us in real time which companies to keep an eye on, based on ratings that have fallen. We don’t get alerted at the first indication, but regular indicators lead us to propose solutions to our customers in difficulty, so that we can secure payment of our invoices.

Coordinator Sales Administration Group

Ayming

To support the company’s growth, it was essential to gain visibility of our customer risk and implement a real recovery strategy.

Financial Manager

Bulteau Systems

To secure our customer risk, we have chosen to interface Creditsafe’s financial information with CashOnTime. This provides collection agents with alerts in the event of an increase in customer risk.

Chief Financial Officer

NTT

Our resources on credit and customer risk

Your questions about credit and customer risk

Why manage customer risk?

Managing customer risk is essential to protect company finances by avoiding losses from unpaid receivables, preserving cash flow and optimizing collection processes. It also strengthens customer relationships by offering appropriate payment terms, while ensuring regulatory compliance. Customer risk management thus ensures the company's long-term stability and viability.

How do you reconcile customer risk management with maintaining good commercial relations?

It is essential to strike a balance between managing customer risk and maintaining good business relationships. This can be achieved by communicating transparently and proactively with customers, offering flexible payment options, adjusting credit limits in line with changes in the customer's financial situation, and favoring a collaborative approach to resolving payment problems.

What are the advantages of using CashOnTime to manage credit and customer risk?

Using a specialized solution such as CashOnTime offers many advantages, such as automating credit management processes, centralizing customer information, providing access to real-time data and analysis, reducing human error, improving operational efficiency, and making decisions based on accurate information. A dedicated solution also enables better management of credit limits, collection policies and customer interactions, helping to minimize risk and improve profitability.

Credit and customer risk

Proactively manage your customers’ financial risk.