Debt collection and reminders

Optimize your DSO and get paid on time!

Automate your processes and improve your cash flow.

Improve your cash flow

-20 days

of payment terms

+15%

free cash flow

+50%

productivity

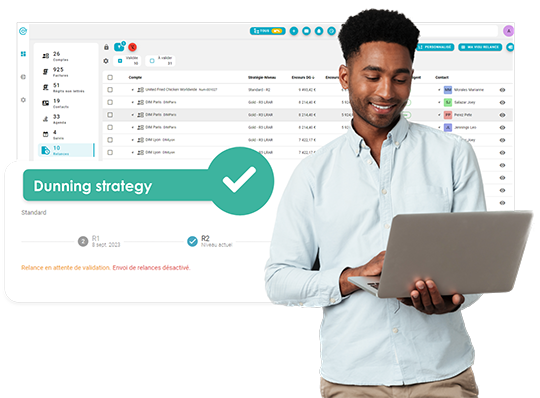

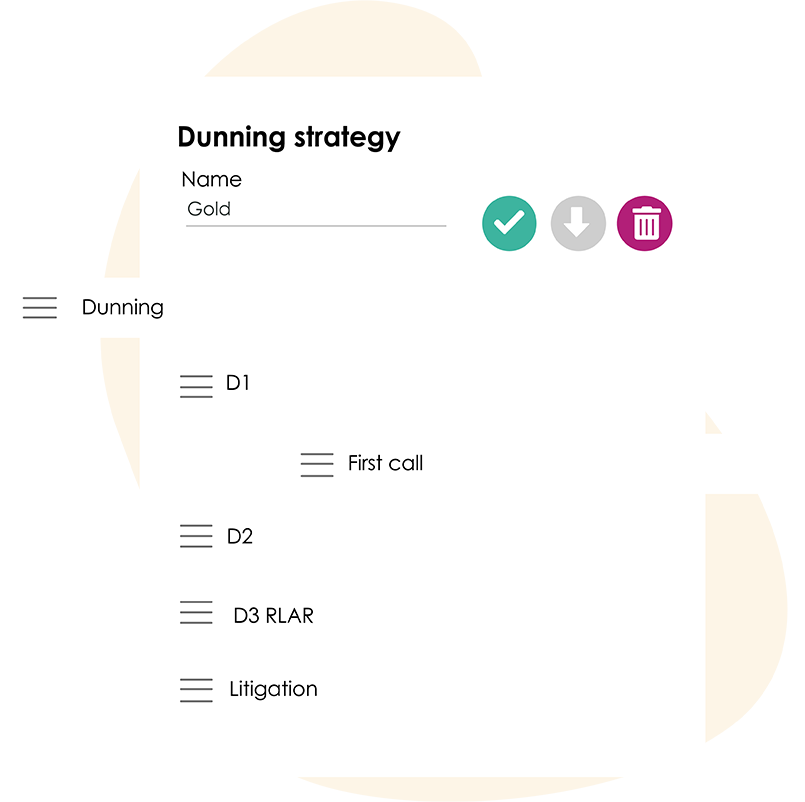

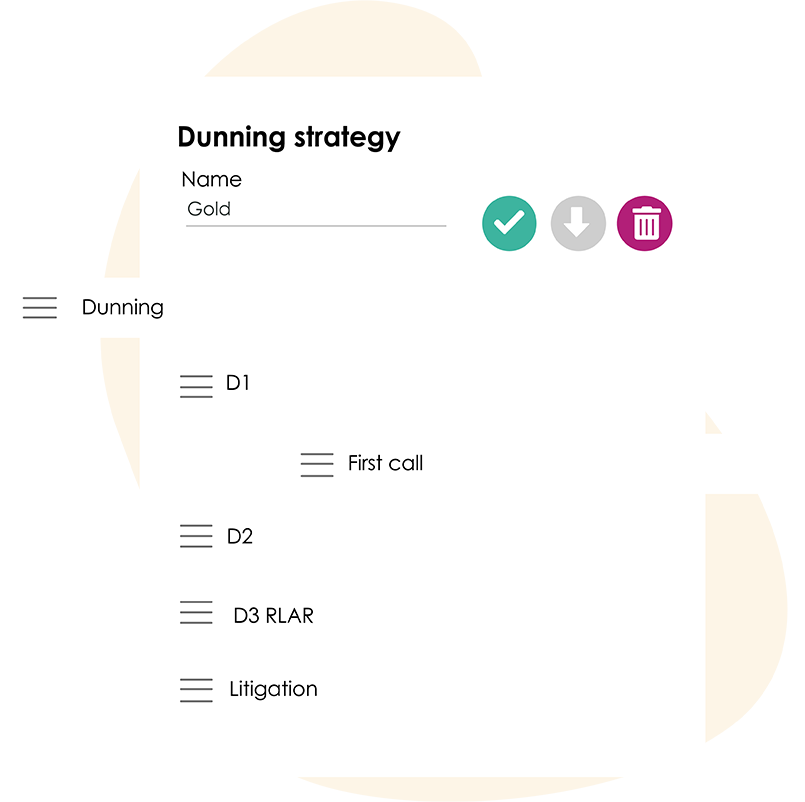

Automate and personalize your dunning

Boost your collection process with artificial intelligence, risk and credit insurance connectors, account prioritization and dunning automation.

Real-time connection to key data enables your staff to save valuable time, optimize their tasks and free up cash, based on customized strategies.

- Create your own triggers.

- Segment your customers for tailored strategies based on risk and customer credit.

- Distribute via the media best suited to your customers’ profiles (e-mail, registered mail, post and SMS).

- Benefit from an optimized schedule for your collection manager.

- Record all dunning actions carried out.

- Access all invoices and delivery notes.

- View progress indicators for tasks completed by agent and supervisor.

- Lead discussions in real time.

- Set up customer-specific billing statements.

- An e-mail inbox (send and receive) for each hierarchical division, with a history integrated into the customer account.

Optimize your Order to Cash process

The CashOnTime solution is distinguished by its ability to cover all aspects of the Order to Cash process, offering a complete, integrated solution for efficient management of your trade receivables.

By centralizing all these functionalities within a single platform, CashOnTime enables companies to simplify their operations, improve efficiency and maximize their bottom line.

- Announcements: payment advice, online payment, Chorus Pro platform.

- Disputes: payment discrepancies on invoices and accounts, customer portal disputes, deductions.

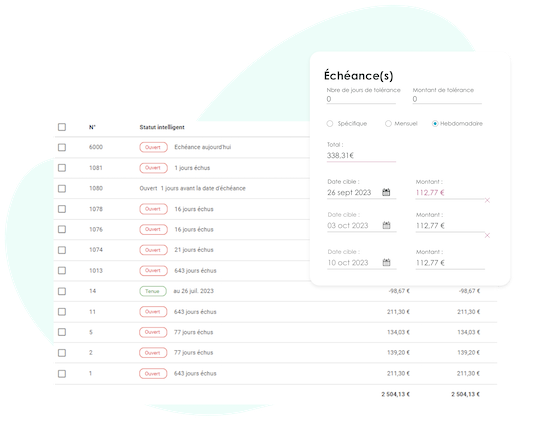

- Promises: on account or invoice(s), payment schedules, interest on arrears, etc.

- Collaboration: collaborative tasks related to customer relations.

- Follow-up: task planning.

- Matching: outstandings updated in real time.

- Litigation: transfer the file to a litigation management company.

Our customers' testimonials

Everyone knows where to start when they arrive at the company in the morning. This is important in view of the volumes to be processed, especially automated tasks, since we have daily reminder proposals.

Accounting Manager

Groupe Chopard

CashOnTime makes it easy to produce customized reports independently. In terms of KPIs, every morning I look at the amount of payments, the rate of overdue invoices, my ageing balance and the number of invoices in dispute. I also load my credit limits, so I can check which accounts are overrun. I have access to customized and à la carte reports, including color-coded customer payment habits.

Administrative and Financial Director

Supplay

With CashOnTime, we saw a very rapid improvement in our DSO (just a few months), as we saved around twenty days. This means that we were able to collect our invoices more quickly, and so experience an acceleration in cash flow. After three years, DSO is still falling!

Coordinator Sales Administration Group

Ayming

Our resources on dunning and debt collection

Your questions about dunning and debt collection

How can a dunning and debt collection solution improve my company's cash flow?

The CashOnTime solution enables you to automate and personalize reminders, making the collection process more dynamic. Risk and credit insurance connectors, account prioritization and dunning automation help optimize receivables management, freeing up cash to improve cash flow.

Why choose collection software?

Choosing a collection software will bring you many benefits:

- Automate and structure collections: CashOnTime's integrated offering is the ideal solution to protect you from all financial risks (insolvency and non-payment) and to optimize your DSO while contributing to lasting customer relationships.

- Gérer les litiges : en intégrant CashOnTime, votre processus de gestion des litiges est structuré, uniformisé, traçable. Tous vos litiges sont traités et vous êtes informés immédiatement de leur clôture.

- Manage and use reporting to support decision-making (all types of aged scales / cash flow forecasts, etc.).

What is the average DSO after using CashOnTime?

On average, we see a 20% reduction in your DSO. The aim is to accelerate cash receipts to improve your working capital requirements (WCR).

Can a payment link be associated with a dunning email?

Yes, with the STRIPE service, you can invite your customer to pay their invoice directly via their reminder.

Can CashOnTime retrieve PDF invoices and attach them to the reminder?

Yes, you provide the link from your DMS to the PDF (public url). This link will then be automatically made in the application.

Does CashOnTime interface with all ERP systems?

Yes, today the CashOnTime platform is interfaced with a multitude of different ERP and accounting systems. Your project will include a technical and functional analysis phase to define and validate the interfaces to be implemented. CashOnTime adapts to your ERP requirements in terms of data format and content.

Are reminders sent automatically by the solution?

Your dunning strategies can be configured according to your preferences.

99% of our customers automatically send out reminders according to predefined strategies, and operate on an "escalation" basis.

However, it is also possible to send out manual reminders from within the tool, if required.

What ROI are your customers seeing?

The benefits are many:

- Improved DSO

- Reduce FTE time by at least 50%.

- Optimization of WCR

We see an average ROI of less than 18 months.