Credit insurance is an essential tool for companies that sell on credit: it protects them against non-payment, provides compensation when a customer fails to pay, and guarantees visibility on the solvency of their customers.

Typical services offered :

- Customer risk prevention (solvency analysis, scoring, etc.)

- Continuous monitoring of customer portfolio

- Management of credit insurance coverage (limits, validity, conditions)

- Claims and compensation in the event of non-payment

Benefits for the company :

- Securing cash flow

- Reduce the financial risk associated with doubtful or unpaid receivables

- Improved business decisions (who to grant time to, under what conditions)

- Better control of receivables, fewer surprises

The Allianz Trade connector with CashOnTime

The Allianz Trade connector with CashOnTime is a technical/software interface that automatically retrieves information on guarantees, caps, credit coverage, scores and other relevant indicators from Allianz Trade systems, and feeds them into CashOnTime as part of the Order-to-Cash (O2C) workflow.

How it works :

- Connector activation: CashOnTime settings for synchronization with Allianz Trade

- Data update frequency: daily

- Data processed: amounts guaranteed, amounts used, validity of guarantees, types of guarantees (permanent, temporary, etc.), customer scores, etc.

- Updating credit limit statuses

- Integration into customer files and financial analyses.

- Management of named and unnamed customer accounts.

Introduction to the “Risk” brick

Adding a risk component means enriching warranty monitoring with proactive tools to quantify, monitor and act on customer risk.

What the risk brick covers :

- Customer credit scores

- Alerts on customer deterioration (e.g.: drop in score, warranty overruns)

- Steering tools: reports, real-time visibility

Benefits :

- Better anticipation of non-payments

- Rapid reaction to weak signals

- Adjustment of payment terms or guarantees according to risk profile

- Optimize cash flow and reduce losses

How can I track my Allianz Trade guarantees in CashOnTime?

In line with its strategy of centralizing all the data essential to customer risk management, CashOnTime integrates Allianz Trade’s guaranteed information directly into customer files.

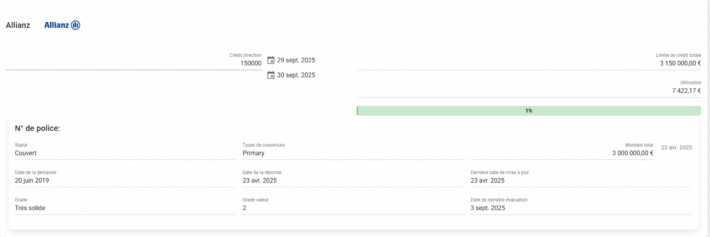

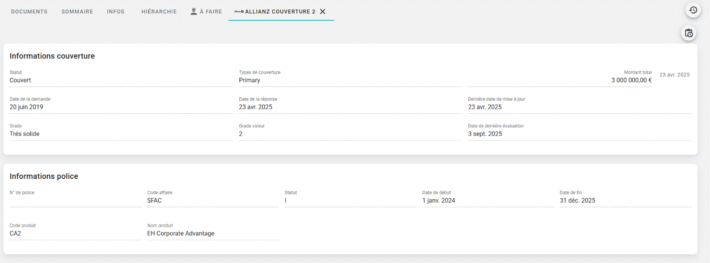

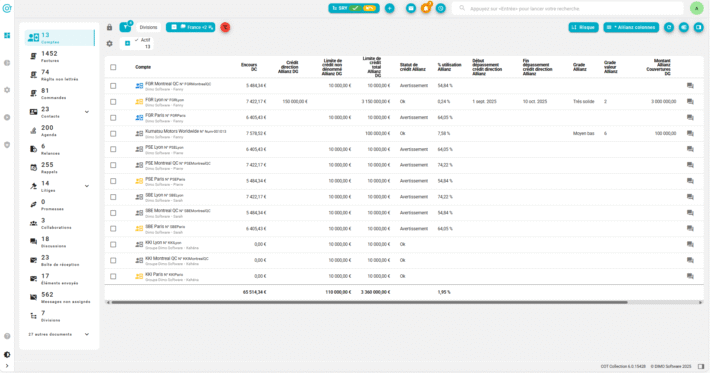

Thanks to this connector, users have a complete, up-to-date view of cou-vertures, with solvency, collateral and risk indicators accessible in real time.

A genuine management tool, this “risk” module not only enables us to monitor existing warranties.

- Activation & initial setup

- Recovery of warranty data, validity, warranty types

- Adjustment by grouping different credit limits (all policies + direction credit)

- Link customer files to their Allianz Trade warranties via the connector

- Track guarantees in customer files

- View for each customer: type and status of cover, amount guaranteed, amount used (calculation of customizable outstandings), date of request, date of response, grade,

- Guarantee validity date

- Customizable alerts and thresholds

- Alerts on solvency score or when customer’s financial situation deteriorates

- Customizable reports

- Global view of portfolio: % of outstandings covered vs. total receivables

- Customer risk ranking

- Real-time indicators: number of expired guarantees, unsecured outstandings, etc.

- Customizable alerts for changes in customer risk categories

Conclusion

By combining the credit insurance and risk modules of the Allianz Trade connector in CashOnTime, you have not only a tool for monitoring guarantees, but also a proactive system for controlling customer risk. This improves decision-making, secures cash flow, and enables you to act quickly to reduce financial losses.