What is DSO?

DSO (Days Sales Outstanding) is a financial indicator used by companies to assess their receivables management performance and collection efficiency. This indicator measures the average number of days between the issue of an invoice and its payment by the customer.

Good DSO management enables companies to anticipate cash inflows and thus improve their cash management, improve their WCR (Working Capital Requirement), since collecting customers more quickly will reduce the company’s WCR. It also enables companies to analyze customer risk by identifying trends and potential customer payment problems.

What are the different methods for calculating DSO?

There are 2 methods for calculating DSO: the accounting method and the sales depletion method (also known as “count back”).

The accounting method is the simplest way of calculating DSO. However, this method is more relevant if the company’s sales remain constant, as it does not take into account the seasonal nature of sales. If a company’s sales are seasonal, it is more appropriate to use the sales depletion method.

The method of calculating DSO by depletion is more complex, but if a company’s business is subject to seasonality, it is preferable to use this method. This method consists in calculating the number of days of sales needed to absorb all receivables.

You’ll find these 2 calculation methods in our downloadable document.

What will you find in this Excel template?

You can use this Excel template to :

- Calculate your DSO using the accounting method

- Calculate your DSO using the depletion method

- Find 7 tips to reduce your DSO

- Discover the different functions of the CashOnTime platform

How do I use this DSO calculation model?

To use this DSO calculation model :

- Start by filling in the form to download the Excel document.

- In the “DSO – accounting method” worksheet, fill in the grey cells in the “Sales” and “Accounts receivable” columns. Your DSO will be calculated automatically and will appear in column F of the table. You can also analyze the evolution of your DSO month by month.

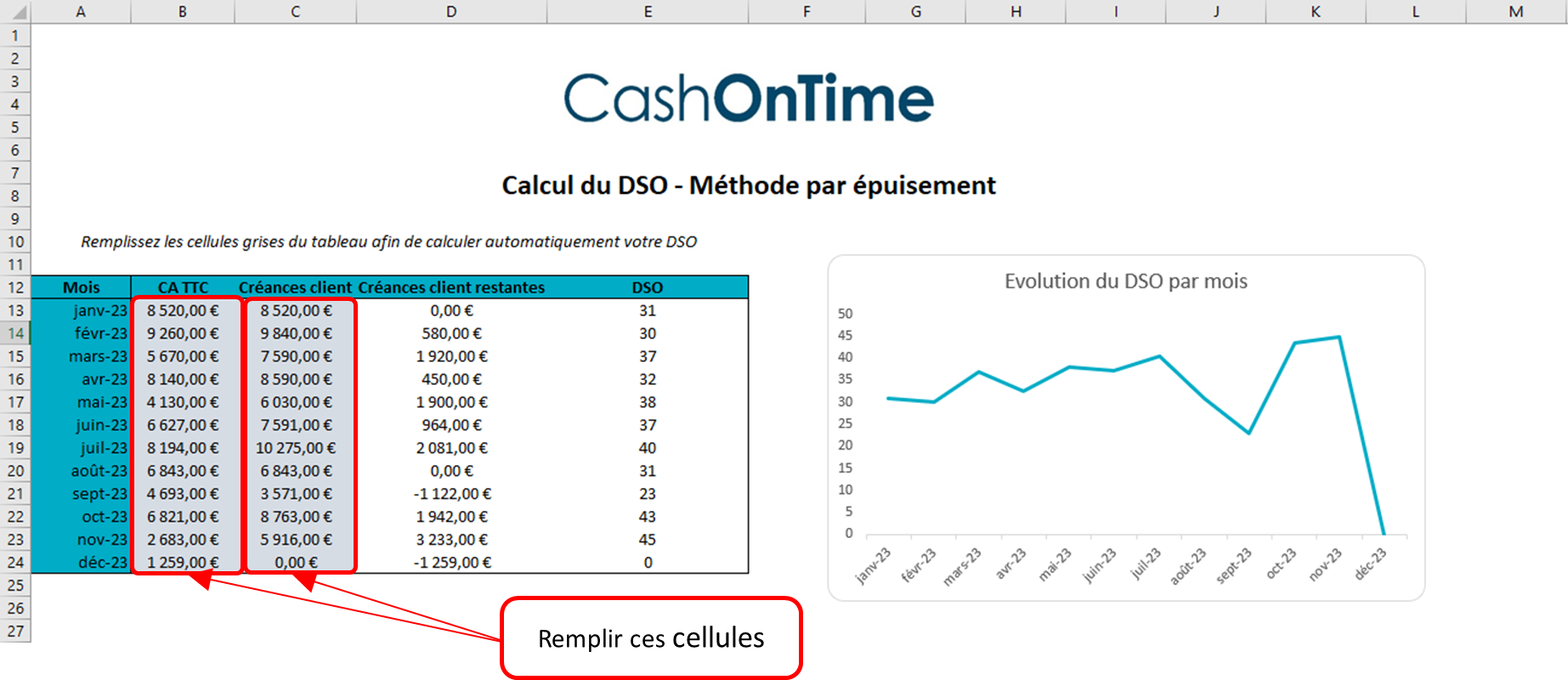

- In the “DSO – depletion method” worksheet, fill in the grey cells in the “Sales” and “Accounts receivable” columns, and your DSO will automatically be calculated using the depletion method. You can also view the evolution of your DSO month by month on the graph.

How do you interpret DSO?

The higher the value of your DSO, the longer it takes your customers to pay their invoices, which can have a negative impact on a company’s cash flow by affecting its ability to pay its suppliers’ invoices itself. On the other hand, the lower your DSO, the shorter your customers’ payment terms, which gives the company more cash and thus reduces its WCR.

There are several levers you can use to reduce your DSO. Download our document for 7 tips. One of these tips is to use collection software such as CashOnTime, which enables you to set up automatic dunning processes using criteria such as payer behaviour and creditworthiness indices, and thus optimize your DSO.

Since we started using CashOnTime, we’ve noticed a very rapid improvement in our DSO (a few months), since we’ve saved around twenty days.

Sébastien Chaize, Coordinator Sales Administration Group – Ayming